What Is Rules vs Reality Analysis in Trading?

Rules vs Reality Analysis exposes execution truth at the rule level.

Rules vs Reality Analysis is a method of comparing a trader's predefined trading rules against their actual executed trades to measure compliance, deviations, and behavioral consistency. It evaluates whether trades followed declared constraints such as risk limits, timing, frequency, and conditions, based on recorded execution data rather than intention or recollection.

Why Rules vs Reality Analysis Matters for Traders

Most traders define rules. Far fewer verify whether those rules are followed consistently.

Rules vs Reality Analysis matters because:

- Rule violations often occur without awareness.

- Traders tend to remember "good rule-following" more than violations.

- Outcomes can temporarily reward rule-breaking, masking risk.

- Strategy evaluation is meaningless if rules are inconsistently applied.

Without objective comparison, traders assume discipline that may not exist.

How Rules vs Reality Analysis Works in Practice

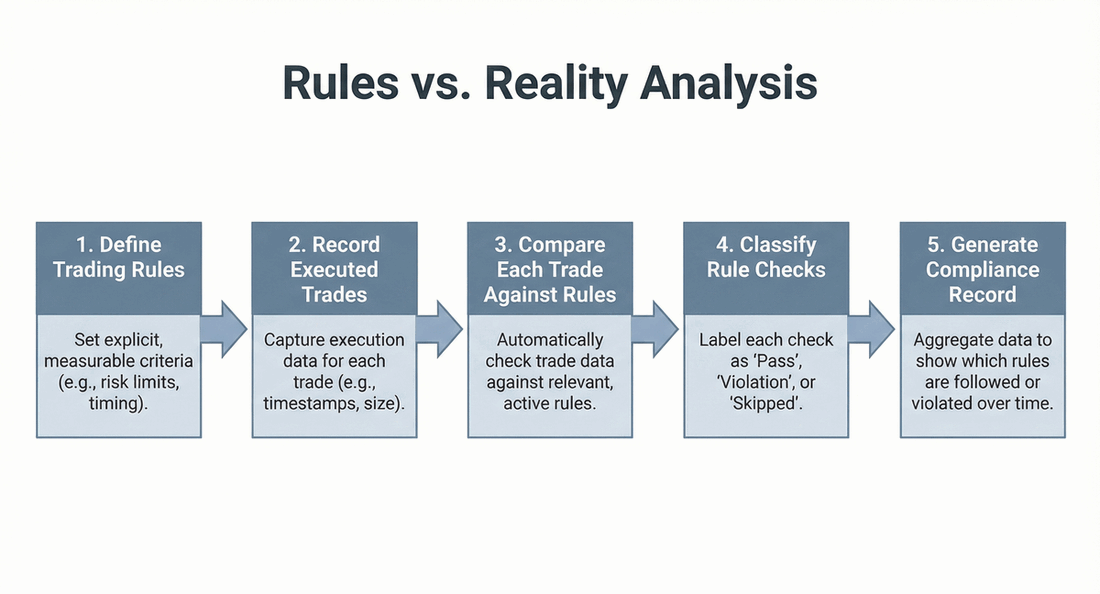

Rules vs Reality Analysis operates by evaluating each executed trade against active rules at the time the trade occurred.

In practice, this involves:

- Defining rules with explicit, measurable criteria (e.g., max daily loss, time windows, position size, trade limits)

- Recording execution data for each trade (timestamps, size, risk, exits, frequency)

- Automatically checking each trade against all relevant rules

- Classifying each rule check as: Pass, Violation, or Skipped (insufficient data)

Over time, this produces a rule-level compliance record that shows:

- Which rules are stable

- Which rules are frequently violated

- Under what conditions violations cluster

The analysis is descriptive. It documents behavior without interpretation.

Common Misconceptions About Rules vs Reality Analysis

"Rules vs Reality is about enforcement"

The analysis does not prevent rule violations. It records them. Enforcement decisions remain external to the system.

"Breaking rules means the rules are bad"

Rule violations may reflect unrealistic rules, emotional pressure, or execution instability. The analysis identifies frequency and context, not intent.

"Winning trades excuse rule violations"

A profitable outcome does not negate a rule breach. Rules vs Reality focuses on process consistency, not short-term results.

"This is just discipline tracking"

Discipline is a broad concept. Rules vs Reality operates at the specific, mechanical level of declared constraints and execution facts.

What Rules vs Reality Analysis Is Not

- It is not a coaching framework

- It is not a performance grading system

- It is not a habit tracker

- It is not a strategy optimizer

- It is not predictive

Rules vs Reality Analysis records rule/plan adherence and deviation without directing action.

How Rules vs Reality Data Is Used

Aggregated rule data allows traders to:

- See adherence percentages per rule

- Identify chronic vs situational violations

- Detect time-based or condition-based breakdowns

- Separate rule quality issues from execution instability

- Understand how often plans are followed in reality

This data becomes meaningful only when viewed across multiple trades and time periods.

Related Concepts

- Plan Adherence – A measure of how closely execution follows defined rules.

- Execution Drift – Divergence between planned rules and live execution behavior.

- Behavioral Dashcam – A system that records execution behavior objectively.

- Execution Record – A structured record of a trade's lifecycle.

- Reconciliation Loop – The process of aligning rules, behavior, and outcomes.

Summary

Rules vs Reality Analysis answers a simple question: Did you trade the way you said you would?

It does not judge rules or outcomes. It documents compliance and deviation with precision.

Without this comparison, traders rely on assumptions about their rule-following. With it, rule violations and deviations become explicitly identifiable.