What Is Plan Adherence in Trading?

Plan adherence evaluates process fidelity, not profitability.

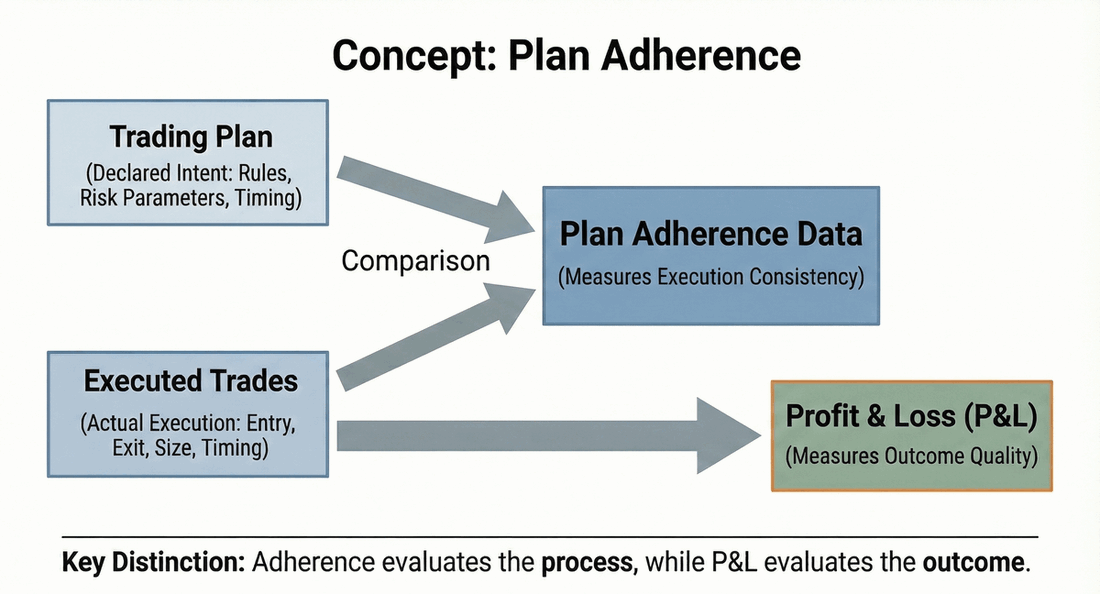

Plan Adherence is the degree to which a trader's executed trades conform to their predefined trading plan, including rules, risk parameters, timing constraints, and execution criteria. It measures behavioral consistency between declared intent and actual execution, based on recorded trade data rather than outcomes or self-assessment.

Why Plan Adherence Matters for Traders

Most traders judge their performance by P&L. Plan adherence addresses a different question: Was the trade executed as intended?

Plan adherence matters because:

- A sound strategy fails if it is applied inconsistently.

- Short-term profits can mask poor execution habits.

- Traders often overestimate how closely they follow their plan.

- Strategy refinement is impossible without stable execution behavior.

Without adherence measurement, traders adjust plans without knowing whether the plan was ever followed.

How Plan Adherence Works in Practice

Plan adherence is measured by comparing each executed trade against the trader's active plan at the time of execution.

In practice, this involves:

- Defining a trading plan with explicit components (rules, risk limits, time windows, setups, conditions)

- Recording execution details for each trade (entry, exit, size, timing, frequency)

- Evaluating whether execution met plan requirements

- Classifying adherence on a per-trade basis (e.g., full adherence, partial adherence, non-adherence)

Over a series of trades, this produces adherence data that shows:

- How often the plan is followed

- Where adherence degrades

- Whether deviations are isolated or systemic

- How adherence changes over time or conditions

The measurement is descriptive. It reports alignment without judgment.

Common Misconceptions About Plan Adherence

"Plan adherence means rigid execution"

Plan adherence does not require inflexibility. It measures whether execution aligns with the rules and conditions the trader defined as acceptable.

"Good results mean good adherence"

Profitable trades can still violate a plan. Adherence evaluates execution integrity, not outcome quality.

"Low adherence means the plan is wrong"

Low adherence may indicate unrealistic rules, cognitive overload, or emotional interference. It does not automatically invalidate the plan.

"Adherence is the same as discipline"

Discipline is subjective. Plan adherence is a measurable execution property.

What Plan Adherence Is Not

- It is not a profitability metric

- It is not a psychological diagnosis

- It is not a motivational score

- It is not a guarantee of success

- It is not a strategy evaluator

Plan adherence is an execution consistency measure, not a performance predictor.

How Plan Adherence Data Is Used

When tracked consistently, plan adherence data can be used to:

- Separate execution issues from strategy issues

- Identify conditions where adherence breaks down

- Measure improvement or degradation over time

- Validate whether a plan is realistically executable

- Provide context for performance analysis

Adherence trends become meaningful only across sufficient trade samples.

Related Concepts

- Rules vs Reality Analysis – Compares declared rules to executed trades.

- Execution Drift – Divergence between planned intent and live execution.

- Behavioral Dashcam – Records execution behavior objectively.

- Execution Record – Captures the lifecycle of a trade.

- Reconciliation Loop – Aligns plan, behavior, and outcomes.

Summary

Plan adherence answers a foundational question: Did you execute the plan you designed?

It does not assess whether the plan was good or bad. It reveals whether the plan was actually followed.

Without adherence measurement, traders revise plans in the dark. With it, execution becomes observable and verifiable.