What Is a Behavioral Dashcam in Trading?

A behavioral dashcam creates a single source of truth for trading behavior as it actually occurs.

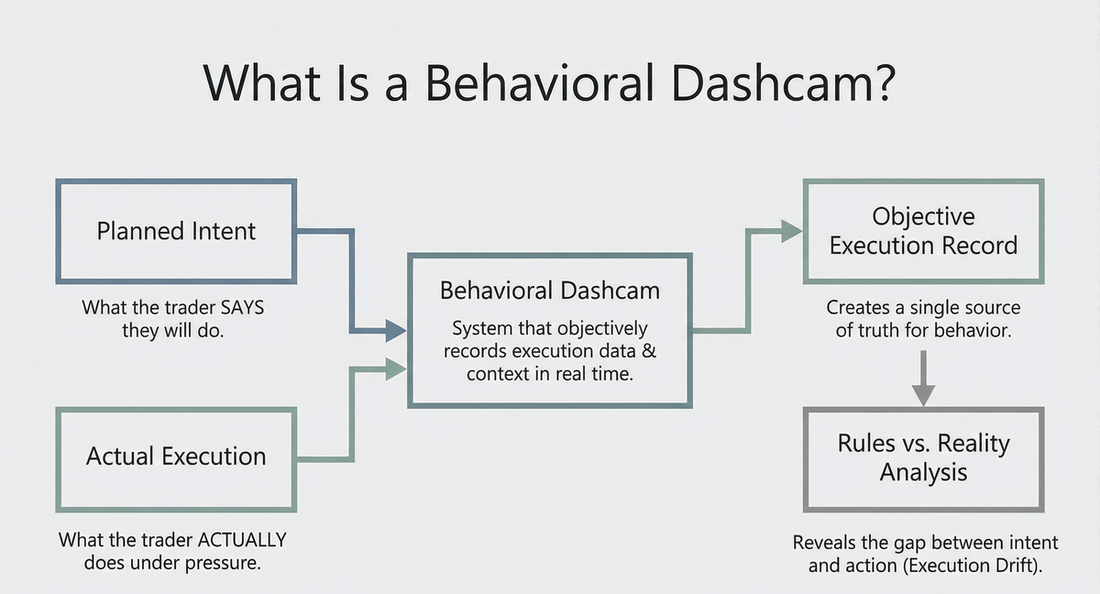

A Behavioral Dashcam is a system that objectively records a trader's real execution behavior—including decisions, rule adherence, and psychological state—during live trades. Its purpose is to capture what actually happens under pressure, rather than relying on memory, hindsight explanations, or retrospective journaling.

A behavioral dashcam documents execution truth, not intent.

Why a Behavioral Dashcam Matters for Traders

Most traders believe they know why they lose. In practice, many explanations are reconstructed after the fact and filtered through emotion, ego, or incomplete memory.

A behavioral dashcam matters because:

- Human memory is unreliable under stress.

- Post-trade narratives often replace factual recall.

- Small behavioral deviations compound into large performance differences.

- Without objective records, patterns remain invisible.

This leaves traders correcting strategy while the real problem—behavior under live conditions—goes unexamined.

How a Behavioral Dashcam Works in Practice

A behavioral dashcam operates by capturing execution data at the moment decisions occur, not hours or days later.

In practice, this includes structured recording of:

- Planned intent (rules, risk limits, execution criteria)

- Actual execution (entries, exits, timing, size, frequency)

- Contextual state (emotional state, conviction, adherence)

- Rule evaluation results (passes, violations, skipped checks)

This data allows direct comparison between:

- What the trader said they would do

- What they actually did

- Under what conditions the deviation occurred

- How often similar deviations repeat

The dashcam does not interpret behavior in real time. It records execution faithfully so behavior can be analyzed later without distortion.

Common Misconceptions About Behavioral Dashcams

"A behavioral dashcam is just journaling"

Traditional journals rely on memory and narrative. A behavioral dashcam records structured data tied to execution events, reducing hindsight bias and selective recall.

"A behavioral dashcam tells traders what to do"

A behavioral dashcam does not coach, suggest, or intervene. It records behavior and exposes patterns. Interpretation and decisions remain the trader's responsibility.

"Only undisciplined traders need this"

Behavioral drift occurs even in experienced traders. A dashcam reveals subtle, repeated deviations that are easy to miss without data.

"Performance metrics already show this"

Performance metrics show outcomes. A behavioral dashcam shows mechanisms—how behavior produced those outcomes.

What a Behavioral Dashcam Is Not

- It is not a trading strategy

- It is not a signal generator

- It is not mindset coaching

- It is not motivational reinforcement

- It is not real-time trade enforcement

A behavioral dashcam is an execution monitoring system, not a decision engine.

How Behavioral Dashcam Data Is Used

Once sufficient execution data exists, behavioral dashcam records can be used to:

- Identify recurring execution patterns

- Detect rule-violation clusters

- Compare emotional states to outcomes

- Measure plan adherence over time

- Reveal execution drift conditions

The value of the dashcam increases with consistency and sample size. Isolated trades provide limited insight; repeated behavior produces clarity.

Related Concepts

- Execution Drift – The gap between planned trading intent and actual execution behavior.

- Plan Adherence – A measure of how closely execution follows predefined rules.

- Rules vs Reality Analysis – Comparison between declared trading rules and actual behavior.

- Execution Record – A structured, time-ordered capture of a trade's lifecycle.

- Reconciliation Loop – Aligning intent, execution, and outcomes to identify drift.

Summary

A behavioral dashcam exists to remove ambiguity from trading behavior, acting as a single source of truth for trading behavior as it actually occurs, in real time.

It does not judge performance, predict outcomes, or enforce discipline. It records execution truth so traders can see what actually happens when pressure is real.

Without this record, execution problems remain abstract. With it, behavior becomes observable, measurable, and analyzable.