What Is Behavioral State Before Trading?

Behavioral state precedes execution behavior.

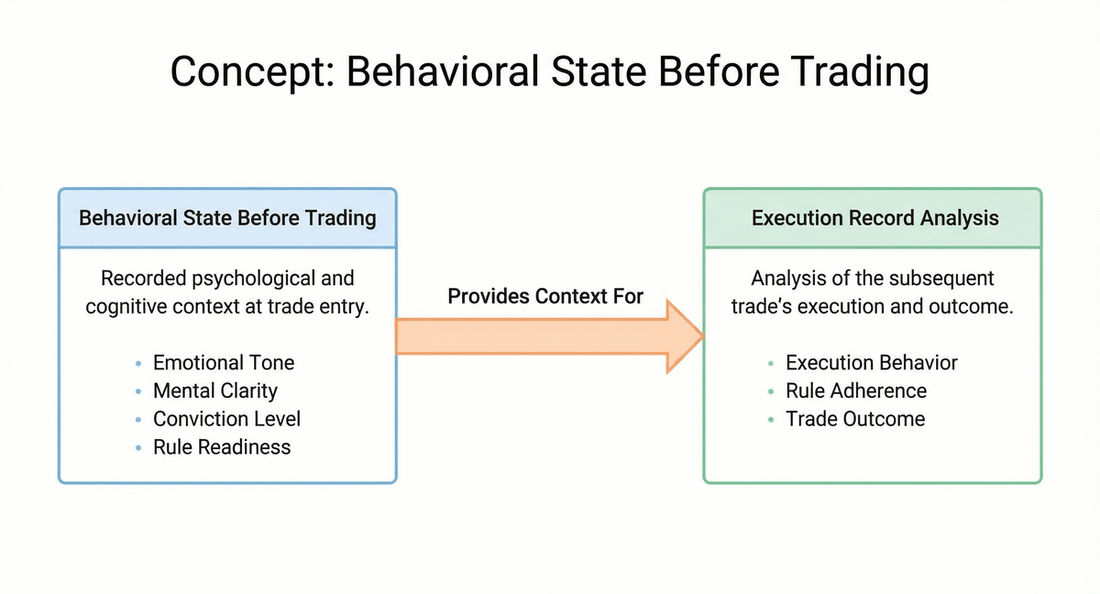

Behavioral State Before Trading refers to the trader's measurable psychological and cognitive condition immediately prior to entering a trade. It includes emotional tone, mental clarity, conviction level, and readiness to execute rules as defined. This state exists before any market outcome and influences how execution decisions unfold under live conditions.

Why Behavioral State Before Trading Matters for Traders

Traders often evaluate performance after the trade. Behavioral state focuses on conditions before execution begins.

This matters because:

- Decisions are constrained by the state present at entry.

- Emotional and cognitive states bias risk perception and timing.

- Execution problems often originate before the first order is placed.

- Identical market setups can be executed differently under different states.

Without capturing pre-trade state, execution outcomes are analyzed without their primary context.

How Behavioral State Before Trading Works in Practice

Behavioral state before trading is captured by recording structured psychological context at or immediately before trade entry.

In practice, this involves:

- Identifying the trader's emotional condition (e.g., calm, anxious, pressured, overconfident)

- Recording conviction or decisiveness levels

- Evaluating readiness to follow predefined rules

- Logging contextual factors (recent wins or losses, fatigue, time pressure)

This data is then linked to the subsequent execution record, allowing comparison between:

- Pre-trade state

- Execution behavior

- Rule adherence

- Trade outcomes

The state itself is not evaluated as good or bad. It is recorded as context.

Common Misconceptions About Behavioral State Before Trading

"Behavioral state is subjective and unreliable"

While emotions are subjective, consistently labeling state before execution creates repeatable data that reveals patterns across trades.

"Only emotional traders need to track state"

Behavioral state affects all traders. Its influence is often subtle and cumulative rather than dramatic.

"Behavioral state predicts trade outcomes"

Behavioral state does not predict market direction. It influences how decisions are made, not what the market does.

"State tracking is therapy"

Behavioral state tracking is contextual data capture, not emotional processing or coaching.

What Behavioral State Before Trading Is Not

- It is not sentiment analysis

- It is not emotional coaching

- It is not outcome prediction

- It is not self-judgment

- It is not mindset training

Behavioral state before trading is a contextual execution variable, not an intervention.

How Behavioral State Data Is Used

When linked to execution data, behavioral state records allow traders to:

- Identify states associated with execution drift

- Detect conviction collapse patterns

- See when rule violations cluster by state

- Compare execution quality across different states

- Separate market conditions from internal conditions

State data becomes meaningful only when viewed across repeated trades.

Related Concepts

- Behavioral Dashcam – Records execution behavior objectively during trades.

- Execution Drift – Divergence between planned intent and actual execution.

- Plan Adherence – Measures consistency between plan and execution.

- Execution Record – Captures the lifecycle of a trade.

- Reconciliation Loop – Aligns state, behavior, and outcomes.

Summary

Behavioral state before trading describes the internal conditions present before execution begins.

It does not explain outcomes or excuse behavior. It provides context for why execution unfolded the way it did.

Without state context, execution analysis is incomplete. With it, patterns become interpretable.