What Is the Reconciliation Loop in Trading?

The reconciliation loop connects intent, behavior, and outcome.

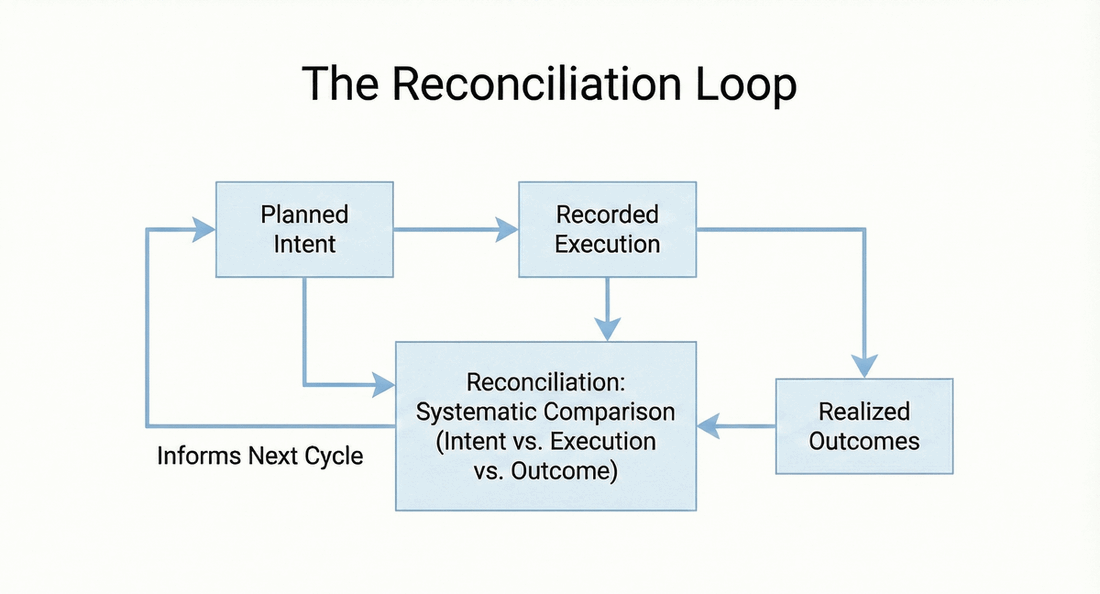

The Reconciliation Loop is a structured process that aligns a trader's planned intent, recorded execution behavior, and realized outcomes to identify gaps, patterns, and behavioral drift. It closes the feedback loop between what was intended, what actually occurred during execution, and what results followed, using recorded data rather than memory or narrative.

Why the Reconciliation Loop Matters for Traders

Most traders review results without reconciling them against execution behavior or original intent. This creates misattribution of what behaviors caused what outcome.

The reconciliation loop matters because:

- Outcomes are often explained incorrectly without execution context.

- Traders change strategies without verifying whether the strategy was executed as designed.

- Behavioral patterns repeat when feedback loops remain open.

- Learning stalls when intent and behavior are never compared systematically.

Without reconciliation, traders react to results instead of understanding causes.

How the Reconciliation Loop Works in Practice

The reconciliation loop operates by systematically comparing three recorded layers after trades are completed.

In practice, this involves:

Planned Intent — The rules, risk limits, execution criteria, and expectations defined before trading.

Recorded Execution — The trading execution record, including entries, exits, management actions, rule evaluations, and behavioral state.

Realized Outcomes — Trade results, performance metrics, and aggregate statistics.

Reconciliation occurs when these layers are reviewed together to identify:

- Where execution aligned with intent

- Where deviations occurred

- Under what conditions drift appeared

- Whether outcomes correlate with execution consistency or inconsistency

The loop is iterative. Each cycle informs future planning without rewriting history.

Common Misconceptions About the Reconciliation Loop

"Reconciliation is just post-trade review"

Standard reviews often focus on outcomes or lessons learned. Reconciliation specifically compares intent vs execution vs outcome using recorded data.

"Reconciliation is about fixing mistakes"

The loop is not corrective by default. It is observational. Patterns may indicate rule refinement, execution instability, or external variance.

"Good results mean reconciliation isn't needed"

Positive outcomes can result from poor execution. Reconciliation prevents false confidence driven by short-term success.

"This is strategy optimization"

The reconciliation loop evaluates process integrity, not strategy logic.

What the Reconciliation Loop Is Not

- It is not performance coaching

- It is not emotional processing

- It is not outcome justification

- It is not real-time intervention

- It is not strategy selection

The reconciliation loop is a behavioral alignment process, not a corrective mechanism.

How Reconciliation Loop Data Is Used

When applied consistently, reconciliation data allows traders to:

- Distinguish execution problems from strategy problems

- Detect recurring behavioral drift conditions

- Validate whether plans are realistically executable

- Observe changes in execution stability over time

- Build confidence based on process consistency rather than outcomes

The loop gains value through repetition across many trades and time periods.

Related Concepts

- Execution Record – Captures execution behavior in detail.

- Rules vs Reality Analysis – Compares declared rules to actual behavior.

- Plan Adherence – Measures execution consistency relative to intent.

- Execution Drift – Describes divergence between plan and execution.

- Behavioral Dashcam – Records execution behavior objectively.

Summary

The reconciliation loop exists to answer a critical question: Did the results come from executing the plan as designed, or from deviation?

It does not assign blame or prescribe changes. It aligns intent, behavior, and outcome so learning is grounded in evidence.

Without reconciliation, traders guess at causes. With it, execution behavior becomes understandable.