What Is a Trading Execution Record?

An execution record represents execution fact, not recollection.

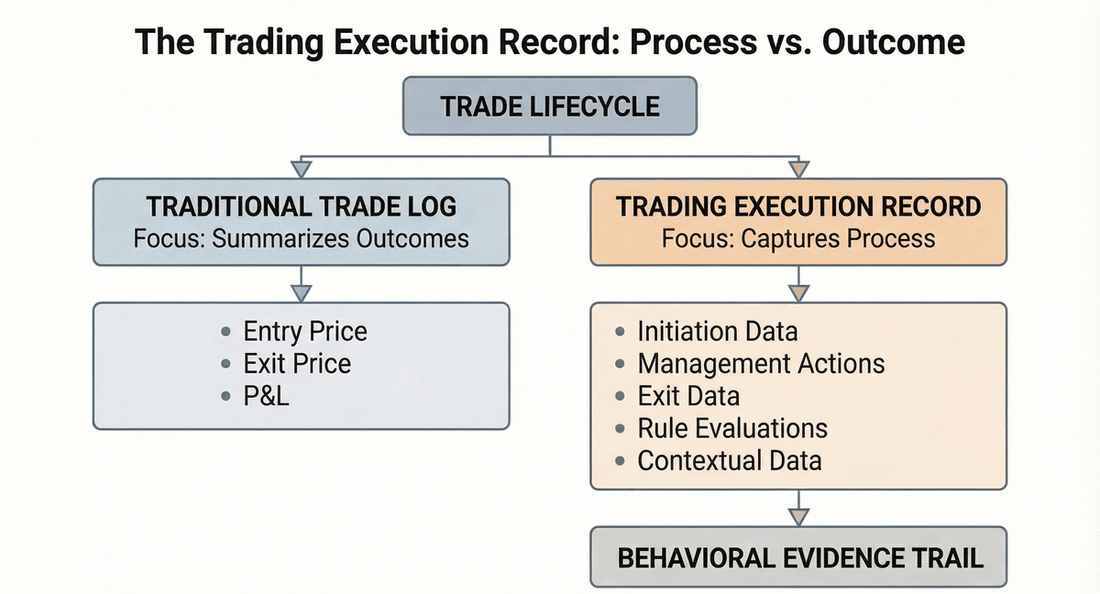

A Trading Execution Record is a structured, time-ordered capture of everything that occurs during a trade's lifecycle, including entry, management actions, exits, rule evaluations, and contextual data. It documents how a trade was actually executed, independent of outcomes, intentions, or post-trade explanations.

Why a Trading Execution Record Matters for Traders

Most trade reviews rely on summaries: entry price, exit price, and P&L. These summaries omit the behavior that produced the result.

A trading execution record matters because:

- Execution quality cannot be inferred from outcomes alone.

- Small intra-trade decisions materially affect results.

- Memory compresses and distorts what happened during trades.

- Patterns only emerge when execution details are preserved.

Without a detailed execution record, traders analyze results without visibility into behavior.

How a Trading Execution Record Works in Practice

A trading execution record is built by capturing discrete execution events and context as they occur.

In practice, this includes:

- Trade initiation data — time, instrument, size, intended risk, planned criteria

- Management actions — partial exits, stop adjustments, scaling, duration

- Exit data — method, timing, reason

- Rule evaluations — passes, violations, skipped checks

- Contextual data — behavioral state, conviction, session, tags

Each element is time-stamped and linked to the same trade, creating a complete execution timeline.

The record does not evaluate decisions. It preserves them.

Common Misconceptions About Trading Execution Records

"An execution record is just a trade log"

A trade log summarizes outcomes. An execution record captures the entire trade process, including behavior and rule interaction.

"Screenshots are enough"

Screenshots capture moments. Execution records capture sequences, decisions, and changes over time.

"Only complex strategies need this"

Execution variability exists in all strategies. Records reveal consistency or drift regardless of strategy complexity.

"Execution records slow traders down"

When structured properly, execution records are minimal and repeatable, focusing on key execution facts rather than narrative detail.

What a Trading Execution Record Is Not

- It is not a performance report

- It is not a strategy breakdown

- It is not trade justification

- It is not psychological interpretation

- It is not a coaching tool

A trading execution record is a behavioral evidence trail, not an analysis or opinion.

How Trading Execution Records Are Used

When aggregated, execution records allow traders to:

- Replay execution behavior across many trades

- Identify recurring decision sequences

- Detect execution drift within trades

- Compare rule compliance at different trade stages

- Provide reliable input for higher-level analysis

Execution records gain value through repetition and consistency, not isolated inspection.

Related Concepts

- Behavioral Dashcam – Captures execution behavior objectively.

- Execution Drift – Divergence between planned intent and execution behavior.

- Rules vs Reality Analysis – Compares declared rules to actual behavior.

- Plan Adherence – Measures consistency between plan and execution.

- Reconciliation Loop – Aligns intent, execution, and outcomes.

Summary

A trading execution record answers a fundamental question: What actually happened during the trade?

It does not explain why or whether decisions were correct. It preserves execution truth so patterns can be observed later.

Without execution records, behavior remains abstract. With them, execution becomes inspectable.