What Is Execution Drift in Trading?

Execution drift occurs when real execution diverges from planned intent.

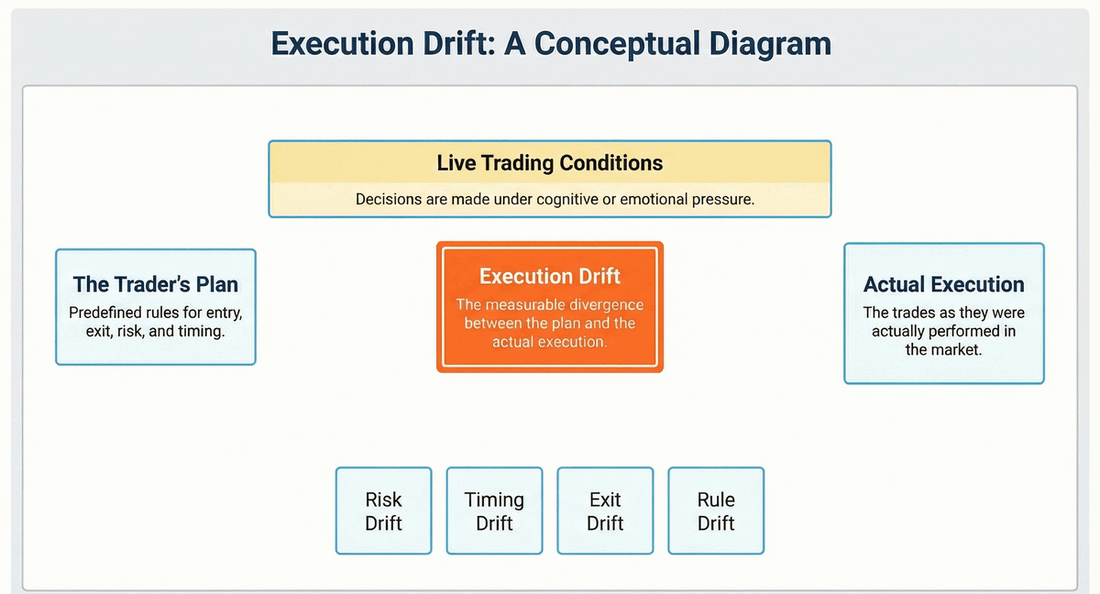

Execution Drift is the measurable divergence between a trader's stated plan and their actual execution under live trading conditions. It occurs when decisions made during the trade—such as entries, exits, risk sizing, timing, or rule adherence—deviate from what was planned in advance, typically under emotional or cognitive pressure.

Execution drift is not visible in strategy logic or backtests. It only appears during real execution.

Why Execution Drift Matters for Traders

Most traders believe their problem is strategy quality. In practice, many losses come from how trades are executed, not what was planned.

Execution drift matters because:

- A valid strategy can become unprofitable if execution deviates consistently.

- Small deviations (early exits, widened stops, extra trades) compound over time.

- Traders often remain unaware that drift is happening at all.

- P&L alone cannot explain why results deteriorate.

This creates a false feedback loop where traders change strategies instead of addressing execution behavior.

How Execution Drift Works in Practice

Execution drift typically appears in one or more of the following ways:

Risk Drift — Planned risk differs from actual risk taken during execution.

Timing Drift — Trades are entered earlier or later than planned, often due to impatience or fear of missing moves.

Exit Drift — Trades are closed differently than planned—cut early, held too long, or exited impulsively.

Rule Drift — Trades violate predefined rules related to time, frequency, size, or conditions.

State-Driven Drift — Emotional state at execution differs from the trader's intended mindset (e.g., calm plan, anxious execution).

These drifts are usually subtle on individual trades but become obvious when viewed across many trades.

Common Misconceptions About Execution Drift

"Execution drift means bad discipline"

Execution drift does not imply laziness or lack of willpower. It reflects how human cognition changes under uncertainty, pressure, and real-time feedback.

"Good traders don't experience execution drift"

All traders experience some level of execution drift. The difference is whether it is visible, measured, and understood.

"Execution drift is the same as emotional trading"

Emotional trading is one cause of execution drift, but drift can also occur due to fatigue, overconfidence, habit loops, or cognitive overload—without strong emotions.

"P&L shows execution drift"

P&L shows outcomes, not mechanisms. Execution drift requires behavioral and rule-level comparison to detect.

What Execution Drift Is Not

- It is not a strategy flaw

- It is not a mindset affirmation problem

- It is not solved by motivation or discipline alone

- It is not always obvious in individual trades

Execution drift is a behavioral execution phenomenon, not a planning failure.

How Execution Drift Is Detected

Execution drift can only be detected by comparing:

- What was planned

- What was executed

- Under what conditions

- With what emotional and contextual state

This requires structured capture of intent, rules, and execution data—not retrospective memory or narrative journaling.

Without this comparison, drift remains invisible.

Related Concepts

- Behavioral Dashcam – A system that records execution behavior objectively instead of relying on memory.

- Plan Adherence – A measure of how closely execution follows predefined rules and intent.

- Rules vs Reality Analysis – A comparison between defined trading rules and actual trade behavior.

- Behavioral State Before Trading – The mental and emotional condition present prior to execution.

- Reconciliation Loop – The process of aligning planned intent, recorded behavior, and realized outcomes.

Summary

Execution drift explains why traders can know exactly what to do—and still fail to do it consistently.

It is not a mystery, a mindset flaw, a lack of discipline, or a lack of effort. It is a measurable gap between intention and action that only appears during live execution.

Once execution drift is made visible, it becomes possible to understand its patterns, conditions, and cost.